Background

Being a trusted brand matters. It is a key driver of brand loyalty, allows companies to charge price premiums, and makes shoppers more willing to try your new products or services. For the past 7 years we have run the BrandSpark Canadian Brand Trust Survey (BCBTS) to understand category trust leaders and what drives trust in each category.

During this time, we have come to a critical insight – it’s not just how many more people trust your brand vs. competitors that matters, but how much more. The former we define as brand trust while the latter we refer to as brand stubbornness. And it’s the interplay of brand trust and stubbornness, and the underlying factors driving them, which really provides the foundation for understanding key brand dynamics in specific categories. We call this the “Trust Landscape”.

Understanding Trust Landscapes

Every category from baby monitors to e-commerce cosmetics retailers has a unique Trust Landscape. A place where different brands compete for consumers’ trust.

How many people stating that a particular brand is “Most Trusted” represents the breadth of trust a brand has.

Brand stubbornness represents the depth of trust individuals have in their current Most Trusted brand.

If it’s very strong, it will be hard to entice people to switch brands. If it’s very weak, many people may switch for even the slightest of reasons.

Overall Trust Drivers vary in importance across category; however, we have found that there are 8 key dynamics at play. These drivers are quality perception, values alignment, consumer voice, innovation, heritage, transparency, customer support, and fair prices.

Through our database we continually update our understanding of Trust Landscapes across hundreds of categories annually within CPG, Services, and e-Commerce. It’s a complex matrix of many different landscapes, with many different combinations of brand dynamics, explained by many different combinations of reasons. And, of course, it is further complicated by certain brands crossing many categories.

Using all this data, we have created a relatively simple framework for understanding each category’s dynamics, along with powerful insights as to why.

Categories are defined by their type of leader

Leaders are always interesting to understand as they set the context for the overall category.

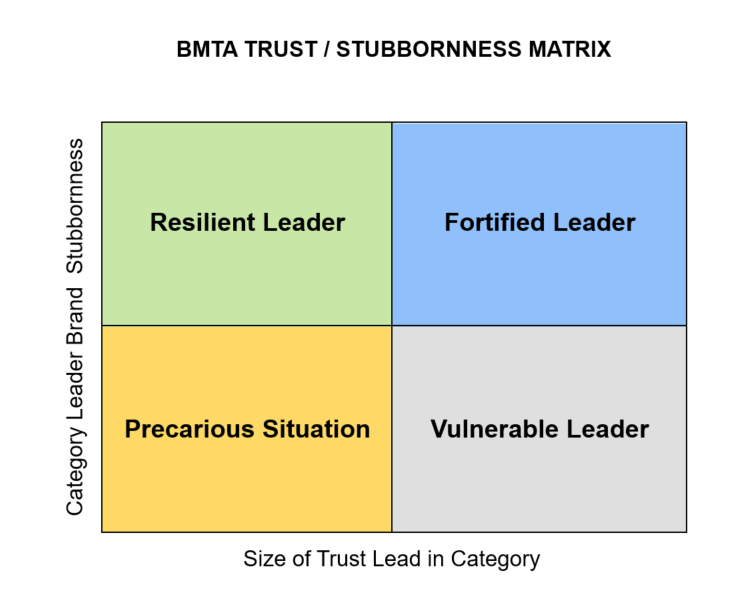

As a baseline for understanding a category, we start with the type of trust leader the category has. This is identified in the BMTA Trust / Stubbornness Matrix, which combines the breadth and depth of trust .

Figure 1. BMTA Trust / Stubbornness Matrix

Fortified Leaders are in the best possible position. They have a large trust lead over their nearest competitor, and those currently with the brand are quite reluctant to switch.

Resilient Leaders have a smaller trust lead, indicating there is at least one other brand close in size. But those with the leader are similarly reluctant to switch brands, meaning these brands have a strong base – and can really focus on trying to broaden their reach.

Vulnerable Leaders face little immediate threat to their trust leadership, given that their lead is so wide. But unlike fortified leaders, those that are with these brands are quite open to switching. This creates the context for disruptive change happening relatively quickly if another (or new) brand emerges with a slightly more enticing brand positioning.

Precarious Situations are just that. The trust lead is small (meaning there is at least one close competitor), and those with the leader are quite open to switching. These are the categories where a new leader can most easily and quickly emerge.

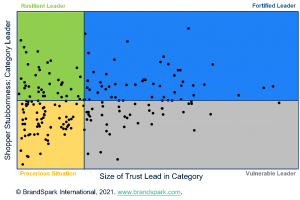

Now one might think there is a linear relationship between trust and stubbornness, meaning most leaders would fall in 2 of the 4 quadrants. But no such linear relationship exists – it varies widely by category. For example, figure 2 shows the matrix for the 2021 BMTAs.

Figure 2. 2021 BMTA Trust/ Stubbornness Matrix

Understanding a category

Having established the type of leader a category has, the next step is determining category dynamics

The first step is always to understand in which order the drivers rank for the category – in other words, is Trust in your category built on Quality and Innovation Perceptions? Or Customer Support and Fair Prices?

Having set this foundation, we then get into specific category context – i.e., the degree of threat the leader faces – based on the trust and stubbornness scores of key challengers.

For example, some “vulnerable leaders” do not really have any immediate threats on the horizon, so things may not change for a long time. Others have 1 (or more) competitors that have established a very strong base, and it is clear they are under immediate threat.

As the different types of landscapes vary so much by category, it’s difficult to talk in “general” terms about them. Upcoming case studies will provide examples of how it all comes together to provide a compelling portrait of a current landscape in a given category – as well as what individual brands within them could focus on to improve their positioning.

Looking for a detailed review of your category? Please reach out to me for more information.