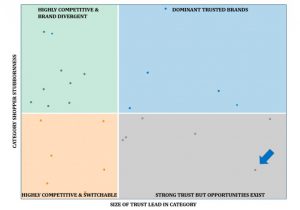

Back in January I introduced the BrandSpark Shopper Trust & Stubbornness Framework. It is a model we have developed that goes beyond brand trust to integrate the underlying shopper stubbornness dynamics – essentially willingness to change one’s mind, even if giving good arguments or rational reasons exist to do so. By understanding these intersecting dynamics deeply, both leading brands and those that hope to catch them can have the foundation to devise more effective brand positioning, marketing and new product launch strategies.

A few weeks ago I provided a brief overview of two of the quadrants (the ones that have very “stubborn” shoppers – which is a good thing if they are yours, bad if you are trying to win them from your competitor). Today I’ll explain the other two, where shoppers are a lot more willing to switch between brands.

Figure 1.

Highly Competitive and Switchable

This is the quadrant that ECO 101 students could tell you they’d want to avoid. There are multiple brands continually slugging it out for trust and category leadership, and shoppers don’t particularly care who wins a given round – they’ll happily and easily switch back and forth. It’s essentially commoditization. Brands that find themselves here obviously need to focus on late funnel tactics (the shelf), and over time try to develop some kind of positioning moat with at least some segment of shoppers.

Brands competing in more “Green” areas, relating to the environment and sustainability, have to be pretty mindful to not end up in this space. For example, some of the least brand-stubborn shoppers we’ve seen are those in “organic” categories – which surprises some marketers, given organic shoppers may be considered a fairly stubborn group. They are stubborn – about getting organics. But as long as it’s organic, they often don’t care which brand it is, and will easily switch between the alternatives.

Figure 2.

Strong Trust but Opportunities Exist

This is the quadrant where the conditions that are in place for a category can be quickly turned on its head, and the category leader might not even see it coming.

For example, if you look at the highlighted category in the bottom right corner of Figure 2. and only take a brand trust lens (x-axis), the category leader is looking good. In fact, we could have told them last year that not only are they the most trusted brand in their category, they have the second largest margin of victory among all food categories. With that information alone, it would be reasonable for brand leaders to say it’s in a great place – and perhaps divert resources to other brands needing more attention.

However, there is another side to the story. Their category shoppers are the 3rd least stubborn of all the food categories. This means that as trusted as the leader may be, competitors can absolutely win them at the shelf with proper execution and market positioning. With some small tweaks they may be able to quickly vault themselves to trust parity or leadership. So this category leader doesn’t have nearly the same flexibility as the dominant trusted brands do and need to be aware of their trust foundations to see where the cracks may exist.

Interested in taking a stubborn look at your category?

BrandSpark has a strong belief that marketers can devise more effective marketing strategies and tactics by deeply understanding the interplay of shopper trust and stubbornness dynamics in their category. The 2020 trust and stubbornness data across hundreds of Canadian categories is now hot off the presses, and we will be periodically sharing some of the highlights and insights throughout the year. If you’d like a more comprehensive understanding of your category and brand positioning within it, please please feel free to reach out.