For many years, Amazon’s ascent to dominate every e-commerce category it touched seemed inevitable – with rare exceptions. It appeared the pandemic might accelerate this. As physical stores momentarily or permanently closed, more shoppers turned online for almost everything from groceries to household supplies – creating the conditions for the long feared “retailmaggedon” as Amazon’s dominance further took hold.

However, there are signs things are starting to shift in a different direction. While Amazon has thrived (sales hitting all-time records), non-Amazon online retail seems to be rebounding. In Canada specifically, BrandSpark International’s recent shopper Ecom study (June 2021) shows there are multiple categories that Amazon is losing share in, and the shopper profile of those leading the change should create optimism that the trend may continue long-term.

Recent Changes in Market Share

One of the categories we’ve seen this in is grocery, where major retailers have embraced digital transformation – and in many cases better taken advantage of their physical locations to offer “hybrid” types of shopping that is appealing to shoppers. Over the last year Amazon has experienced a decline in share of food & beverage purchases, to the benefit of Walmart in particular.

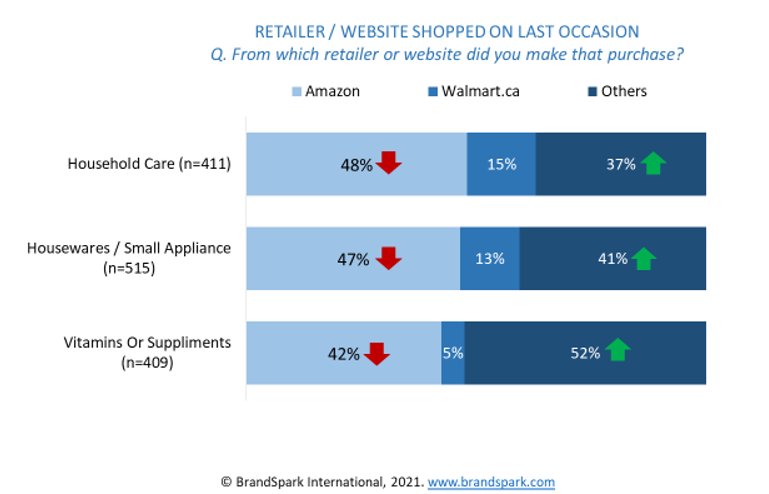

But Amazon’s share loss is not just a story of food & beverage, nor one of a battle with Walmart specifically. Amazon has also lost online share in categories such as household care, small appliances, and vitamins – all at the expense of other (non-Walmart) retailers (See Figure 1).

Figure 1. Online retailer shopped on last occasion by select category

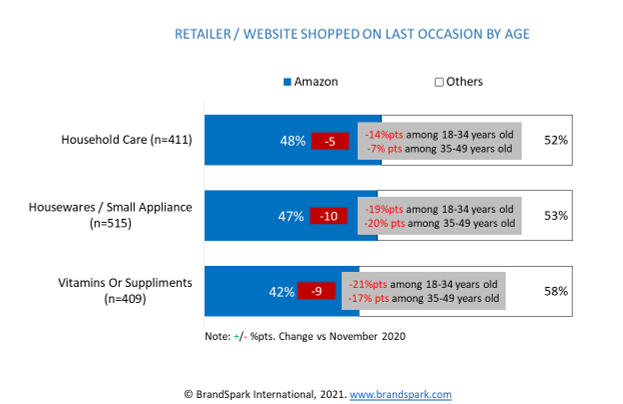

A reasonable hypothesis would be that this shift is being driven by older shoppers being “forced” online by COVID sticking with their real-world brands. But encouragingly for these other retailers over the long term, it seems to be younger shoppers are the ones behind much of the change (See Figure 2).

Figure 2. Online retailer shopped last occasion – by age

Shoppers – particularly the younger ones – are looking beyond Amazon to meet their needs in a varied assortment of categories, creating increased opportunity for other retailers. And a different landscape for manufacturers to consider.

Shoppers exploring more online via search engines

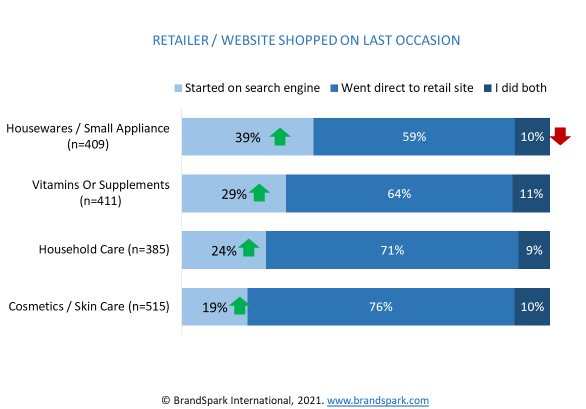

What’s particularly interesting about this change is that it’s not being driven by shoppers simply selecting a different retailer (say, after seeing the store front) – but rather exploring their options online and ending up somewhere else. In each of the three categories noted, the key change in behaviour seen is that more shoppers were starting their shopping trip with a web search, rather than going directly to the retailer website (See Figure 3). This means that beyond changing the retail competition dynamics, it also creates heightened opportunity for “direct to consumer” brand distribution.

Figure 3

It must be noted the value-seeking behaviour of shoppers remains as strong as ever, and appears part of the shift as well – with a significant increase in shoppers checking prices across multiple sites.

Another positive sign for Amazon’s competitors is that after hitting record levels in 2020, we’ve seen some decline in satisfaction with the service overall, again driven by younger shoppers.

Now that online shoppers have multiple credible online retail channel options, shoppers are inclined to explore these options to find products that fit their needs and requirements. This habit of exploration in online shopping also paves the way for discovery experiences that can lead shoppers to unexpected buys in the end. It is therefore paramount for retailers and brands to maintain their visibility on search engines and even invest in promoted listings.

These are just some of the many learnings uncovered from our recent shopper and e-commerce studies. If you’d like to learn more about how to access these syndicated or custom reports, contact us today at info@brandspark.com.