The scale of Amazon’s e-commerce dominance

That Amazon is a dominant force across most e-commerce categories should be a surprise to no one. And their overall strength appears to be growing, given that their brand stubbornness – i.e. reluctance of those that trust them to even consider alternatives – is strong across most categories. In fact, of the 11 categories Amazon is ranked 2nd on overall trust, they have a higher stubbornness score than the leader in 10 of them. In the categories Amazon already leads, Amazon has a higher stubbornness score in the majority. Momentum is on their side, at scale.

Sephora is the notable exception to Amazon’s rule

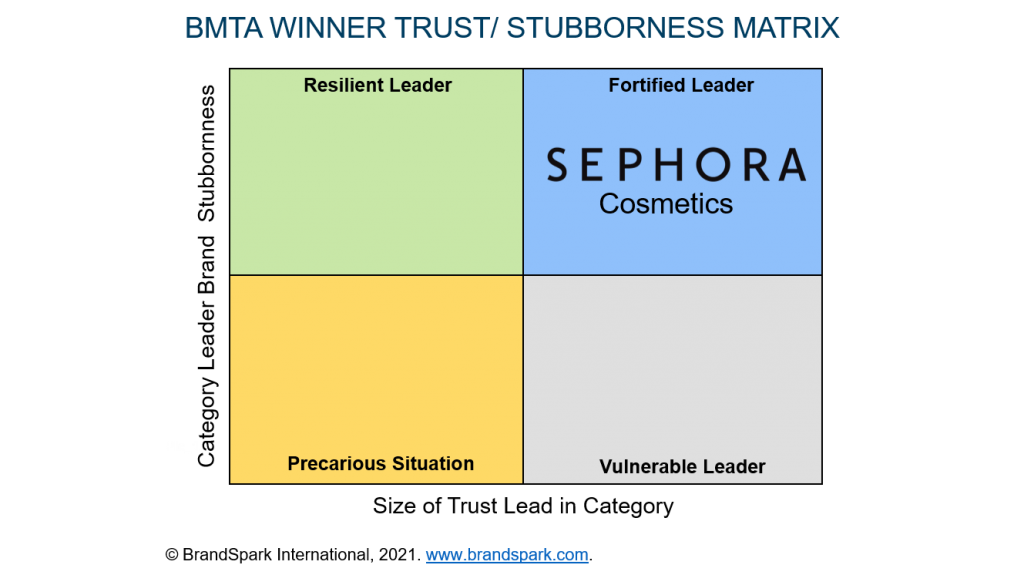

But there is one notable exception to Amazon’s seemingly impenetrable dominance in Canada – Sephora. In cosmetics, Sephora has not only maintained a large trust lead over Amazon, but their brand stubbornness is significantly higher as well. This combines to make them a fortified leader in that other brands looking to compete with Amazon can learn from (for a background on the BrandSpark trust and stubbornness model, please see Scott Boyer’s recent post).

Figure 1. BrandSpark Trust & Stubbornness Matrix

The three key pillars of Sephora’s success

So how do they do it? Well, it’s certainly not about price. Amazon enjoys a significant fair price advantage in every single one of the categories we noted, including cosmetics. In fact, Sephora is weaker on “fair prices” than a number of other brands that have been far less successful in warding off Amazon.

There are three key pillars to how Sephora has succeeded while being at a significant disadvantage on fair prices.

- Sephora’s ‘Quality’ score is off the chart.

Within the BMTA database, we establish the “gold standard” for performance on a particular benchmark at the 80th percentile – i.e. the company outperforms 80% of BMTA winners. Sephora not only beats this benchmark, it blows it away – exceeding it by a wider margin than the 80th percentile exceeds the average. No other BMTA e-comm winner is at the level, and an example of one of the few brands they lag in overall services would be The Keg in upscale casual dining restaurant chain. It is rarified company.

- They layer other differentiating strengths around the quality core.

‘Transparency’ and ‘Heritage’ are two other areas where Sephora manages to outperform Amazon, which helps support their quality leadership in the category. But the key word here is “support”, particularly in terms of heritage. Many Amazon competitors have a heritage advantage, given most have been established in the category for much longer (and often specialize only in it). Relying just on that category longevity is not enough.

- They neutralize Amazon’s other common advantages.

‘Customer support’, ‘endorsement’, and ‘innovation’ are among the other areas that Sephora has managed to perform at the same level as Amazon. Many of Amazon’s competitors struggle with these in other categories, allowing Amazon to assume the enviable position of now just being the low price leader – but also being recognized (and recommended) for their superior customer support. Sephora has not allowed them to do this in cosmetics, and is reaping the benefits.

Sephora’s strength is not about prices – it’s about everything else

Sephora’s key to beating Amazon was not about trying to compete with them on low prices. It is about maintaining clear leadership on quality, and leaving Amazon with only fair prices as a competitive strength.

How Sephora delivers a quality cosmetics buying experience

The starting advantage that Sephora has over Amazon as a “specialized retailer” is that the entire online experience can be designed around health & beauty. Arriving at the site a shopper is immediately immersed in the category, while arriving at Amazon is more akin to a department store – one has to find their way to the section, and other parts of the store seem to always be vying for attention.

But this is an advantage many other brands competing with Amazon have – what makes Sephora so successful is how they use it. Some notable elements include:

- They communicate products of consistently high quality. Product seals like “Clean at Sephora” (and many others) are strong quality cues that help shoppers build trust through transparency – that supporting strength noted earlier.

- Curation, curation, curation. There is a lot of choice out there, and it can become overwhelming – particularly on sites like Amazon. Sephora has a lot to choose from, but curates its offerings and suggestions in a multitude of different ways to point shoppers towards what they might not even know they are looking for.

- Product exclusivity is commonly featured. It is difficult to navigate anywhere on the site for too long without running into multiple products that are “only at Sephora”.

- They’ve built their heritage into a strong online community. Building on their long history in the category, an active “beautyinsider community” is layered on top – with over 4 million members and 2.6 million posts.

- They are open and honest with their customers. Shoppers are provided with extremely detailed information on products, sometimes right down to clinical results from studies.

- They use physical stores to help neutralize the Amazon Prime advantage. 24-hour delivery has revolutionized e-commerce retail. But 24 hours is still a long time for many purchases, and reserving online to pick-up in an hour can be extremely attractive.

“Resilient Amazon Challengers” are similarly maintaining a quality edge

Given that Sephora is unique in being a “fortified leader” in Canada, it might seem reasonable to believe lessons from it can’t be applied across other categories. But when we look at other categories where brands are having relatively more success than others competing against Amazon, similar themes to what’s noted above emerge.

For example, there are several categories where Amazon leads but the top challenger continues to hold a relatively large trust share, and outperform Amazon on stubbornness – indicating good resiliency and potential positive momentum. Examples include MEC in outdoor gear, LuluLemon in Women’s Activewear, and Chapters/ Indigo in books. What’s common across all three examples is they exceed the “gold standard” on quality. In contrast there are categories like pet food (PetSmart) and electronics (Best Buy) that are closely contested, but momentum is entirely on Amazon’s side- lower prices, and an essentially equal quality score.

Similar findings emerge when looking at categories Amazon is #2. The brands showing more resiliency outperform on quality – such as La Senza in Women’s Lingerie, and The Bay in Women’s Luxury Fashion). Leaders we currently project to experience significant trust erosion over time (including Sport Chek in Sporting Goods, and Staples in Office Supplies) can be explained fairly simply – Amazon beats them on price, and is close to equal on quality.

But the quality differential isn’t the only thing that separates Sephora from the others fortified leaders. In basically every category we look at, the leading brand competing with Amazon has a number of weaknesses, and/or a plethora of parity points with few real advantages to compensate for the higher price perceptions.

For example Micheal’s is in a tight battle on craft supplies. Their quality lead is helping them hold on, and they have supporting strengths in heritage, endorsement and values. But customer support and transparency are lacking. In contrast, La Senza has equalized Amazon on customer support and transparency, but lags behind on recommendation (and has fewer overall strengths).

Each situation is a little bit different. But if you want to compete effectively with Amazon, the message is clear. Given Amazon’s advantage on prices, a brand needs to really differentiate on quality – while also at least neutralizing their other strengths as much as possible, while ideally layering on additional differentiation points that support the quality message. A variety of brands demonstrate how this makes a company more resilient in their battle against Amazon. Sephora is the guiding light on what can happen if you wrap it all together.

Next Steps

BrandSpark International is continually updating our learning and insights around brand trust & stubbornness through detailed analysis of 100s of categories in our database. If you’d like to learn more about your company’s positioning within one of those categories, or test how you perform on another category in relation to our benchmarks, please reach out and contact us.

© Copyright 2001-2021 BrandSpark International Inc. All Rights Reserved. Logos and names are registered trademarks.